2024 LegacyFX Review Pros, Cons & More

Bank wire transfers can be used to deposit funds at this brokerage. Processing times for bank transfers tend to depend on the bank being used, but typically take around one to three days to arrive in your LegacyFX account. Your bank can provide further details on legacy fx review how long the funds will take to clear and advise you if there are any bank-levied charges. There is a minimum withdrawal amount when using wire transfers, currently set at €150. Card payments are accepted, with the option to pay with both credit and debit cards.

📵 What deposit and withdrawal methods LegacyFX supports?

As this software is offered under license by a third-party (MetaTrader), it’s necessary to complete some additional online paperwork and accept a Terms of Service agreement. Legacy FX do well to provide a helpful breakdown of what is needed in the FAQ section of their site. Processing times for withdrawals range between 1-3 days, which is in line with standard market practice. Legacy FX don’t charge any withdrawal fees, but all the paperwork relating to your account must be completed before the broker is allowed to release funds. The broker has a total of three account types that cover the needs of every single trader that registers.

Popular Forex Broker Reviews

Next to it is an ‘Open Demo Account’ option for those who want to start off trading virtually. LegacyFX launched way back in 2012 and, with that in mind, it is safe to conclude that it has a decent user feedback score. Since its launch, it has received plenty of reviews from customers – with positive ones outweighing the bad. Overall, the customer service at Legacy FX is great, and the agents were able to answer all our questions in a professional and timely manner. Selecting a safe and reliable broker is critical for successful currency and CFD trading. Rules and guidelines are set in place by regulators to protect investors from fraudulent behavior from brokers.

- With that being said, the broker cannot allow all traders from the EEA.

- People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active.

- With LegacyFX you will need a minimum deposit of $500.You can sign up for a demo account to acquaint yourself with LegacyFX platform.

- I personally think this is satisfactory regulation and wouldn’t have any problems trusting this broker.

Trading experience, support,

Here is a screenshot of the LegacyFX MT4 Premium trading account during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads. The minimum deposit is the equivalent of $500 for a Silver account, $5,000 for a Gold account and $25,000 for a Platinum account. The sums are not hugely accessible so if you are looking for more competitive options, see our list of alternatives below.

Local restrictions /Cross-border services

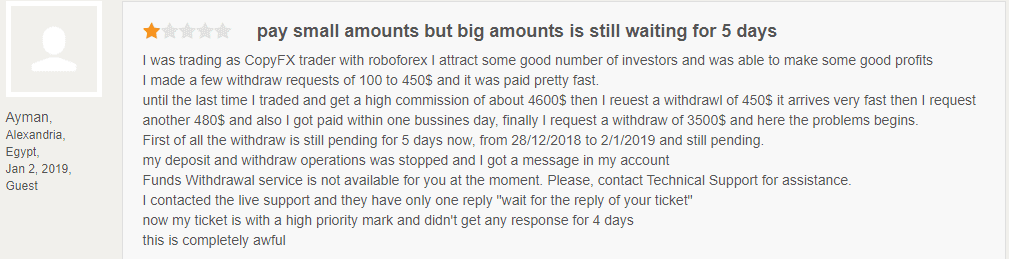

I requested for my money back after a month, to which i was told to pay an undiscussed tax fee on the investment. I reluctantly paid this but was still denied access to my funds. I started calling the customer support but i received no response or feedback. This went on for days until i reported them to the FCA, whom informed me about the illegitimacy of their operations. I thought i had lost all my money until i reported them to BermudaFinance Security, a cybersecurity firm.

As platform choice at Legacy FX is limited to MetaTrader’s MT5, there is no need to consider different options. Traders that want to register for the (supposedly) most popular account option of the broker will have to be ready to spend up to $5,000 without looking back. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in the use of our website. LegacyFX operates an EU-based subsidiary with regulation from the CySEC and the FCA.

LegacyFX is a Multi-Assets Trading Platform with over 200+ Assets

Equity trading requires $3,000, and access to the dealing desk is available from $5,000. When it comes to trading fees, things get a bit complicated at LegacyFX. The spreads on all assets, and the commissions for equity CFDs, are very high, making https://forexbroker-listing.com/ LegacyFX an expensive broker for scalpers and short-term traders unless they have a minimum of $25,000 to deposit. No fees are charged for the first 6 accounts, but the VIP account is customizable and may carry certain additional charges.

Stop Loss orders are guaranteed only during market hours and under normal trading conditions. The effect of leverage on profits and losses magnifies them in both directions. In other words, LegacyFX leverage profits and losses are magnified when trading. For instance, using CFDs, you use the LegacyFX trading platform to buy/sell $10,000 worth of Apple Computer Inc.

Legacy FX offers access to MetaTrader 5 (MT5), which is the most popular multi-asset platform on the market today. As the successor to the infamous MetaTrader 4 platform and offers advanced features and tools. Swap Free on all LegacyFX Account Types (Silver, Gold, Platinum). LegacyFX charges no swaps on long-term positions, providing ideal conditions for long-term trading and investment. For full protection of investment, LegacyFX operates negative balance protection along with complete segregation of client funds from the company’s assets.

A LegacyFX demo account provides a risk-free environment for experimenting with the LegacyFX platform’s features and trading strategies before risking your actual funds. This approach can help you gain experience and confidence in LegacyFX trading decisions. Please be aware that trading in financial assets with LegacyFX carries a risk of loss. LegacyFX trading risk can occur due to inadequate market research, lack of experience, or failure to use the platform tools. Therefore, you should only risk trading when you understand that your capital is at risk at any time.

CTrader Automate allows LegacyFX traders to create algorithmic tradingrobots to automate financial trading plans. Dealers can use cTrader’s contemporary C# API to writecode within the LegacyFX cTrader IDE, which allows developers to optimize and test their financial robots. The Autochartist interface is user-friendly and can be customized to suit individual trading preferences. LegacyFX traders can navigate the platform and find the information they need to make informed trading decisions. Autochartist on the LegacyFX platform is a powerful tool designed to help traders find trading opportunities quickly and easily.

In addition, we tested LegacyFX support services in various countries and languages and found that LegacyFX were able to effectively resolve our customer issues. Our team tested the live chat support of LegacyFX and found it to be satisfactory. While we received a response within 25 minutes on most occasions, there were instances where we did not receive a response at all. Explore the LegacyFX platform and train yourself to think systematically and logically about the markets. Like other brokers, LegacyFX margin requirements can differ depending on the traded instrument.

Trading CFD trades on the LegacyFX platform can provide more flexibility than traditional market trades, allowing access to CFD fractional shares, international markets, and short selling. They are commonly used for short to medium-term trades, such as intraday CFD trading, but are high-risk due to their separation from the financial markets. It’s essential to note that the trading instruments offered under the LegacyFX brand may vary depending on the customer account holder and country of residence due to regulatory restrictions. Besides, the trading platform the customer selects may also impact the available trading instruments.

LegacyFX provide a wide variety of CFD trading instruments across multiple asset classes for trading online including a good selection of stocks, commodities, indices, metals, cryptocurrencies and forex currency pairs. A contract for differences (CFD) is a financial contract that pays the differences in the settlement price between the open and closing trades. This means that you can speculate on which direction the price will move without needing to physically own the underlying asset.

When a trading account goes unused for a certain period, brokerage clients may be charged an account inactivity fee. To avoid such fees, clients may need to fulfill specific trading activity requirements outlined by LegacyFX terms and conditions. It’s important to note that inactivity fees are not unique to online trading accounts, as many financial service companies may also charge them. There is also a useful and extensive education section offering training, learning and research materials.

In addition, LegacyFX has partnered with Trading Central to offer a suite of analysis tools to equip traders with the relevant information to make informed investment decisions. The financial products offered by the promoted companies carry a high level of risk and can result in the loss of all your funds. LegacyFX offers a dozen global equities from Germany, the USA, Switzerland, Netherland, Belgium, Spain, France, Norway, and the United Kingdom. You can also find ETF or exchange-traded fund stocks on their platform. Considering the number of stocks available on LegacyFX, traders definitely have the opportunity to diversify their portfolios. Whether you want to trade Forex, Stocks, Commodities or Indiceswe will help you find the best online broker for you from 400+ brokers for clients based in theUK, Europe, Asia, South Africa and Australia.